The DEX to Rule Them All

Uniswap recently unveiled the vaunted third version of its world-beating DEX. Reactions have been mixed, primarily over the uncertainty of how V3 changes the dynamics between active and passive liquidity providers (LPs). Considering the Parsec Research piece back in the fall on the matter - Citadel's Sharpe Is Uniswap's Opportunity, a follow up is necessary. The V3 design presents as a viable attempt to invalidate the tradeoff space outlined in the piece and harmonize active and passive LPs.

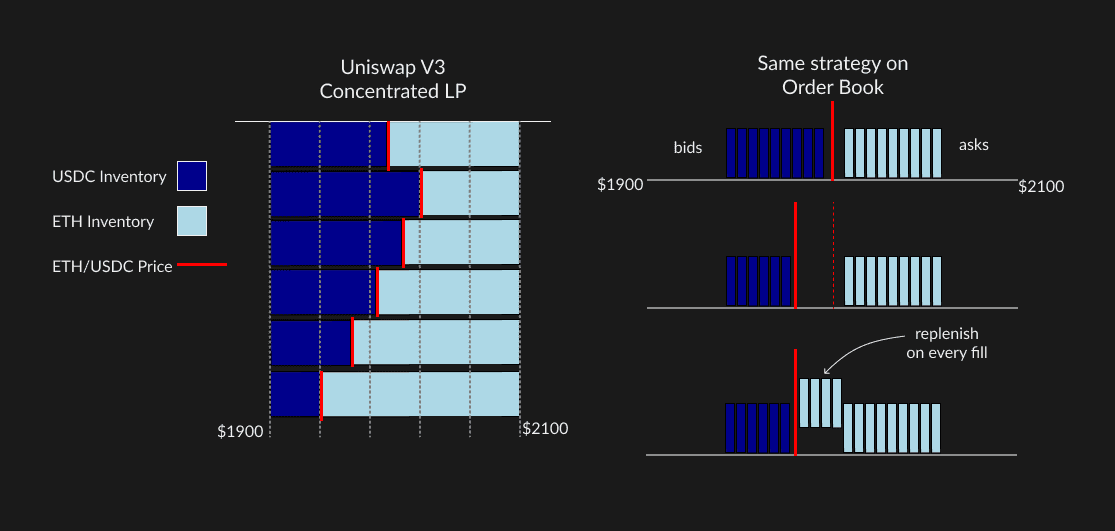

On one hand, V3 is a superset of V2, if all LPs were to provide liquidity from [-∞, ∞] then you have the same pricing curve as V2. On the other hand, LP's can now provide liquidity in individual buckets similar to a limit order book. The upgrade is transparently targeted at improving the experience for price takers. Naturally the question becomes - why not just build an order book if we are already sacrificing lazy liquidity? The answer is a mix of computing environment constraints and a challenge to the idea that lazy liquidity need be sacrificed.

Order Book v. Uniswap V3

In a standard limit order book (LOB), the venue provides a tick size for a market (usually $0.01 for stocks, crypto all over the place). Given that tick size a maker can place distinct orders on any tick, all of which must be managed independently. In V3, a similar set of ticks is determined, but the maker here specifies a range of ticks to spread the order across. This allows for a mix of passive and active strategy, but importantly reduces the number of operations significantly for certain semi-passive strategies. Imagine an LP has a thesis that ETH/USDC will range between 1900-2100, instead of placing receding bids and asks and managing the inventory you accrue, a V3 spread position does this all in one action, significantly reducing tx costs as well as maintenance overhead.

Due to V3 spreading orders across a range, when an order traverses a tick it matches against LP capital pro-rata. This is meaningfully different from a LOB which matches against distinct limit orders FIFO. This is the type of detail that sounds insignificant, but I assure you it is not. In every liquid exchange environment, very very minute execution details can have a very large impact on algo traders optimal strategies. This is particularly salient in the context of public blockchains where the optimal strategy can have negative externalities on the whole chain. Since execution order and fees accrue to makers pro-rata it seems likely there will be a reduction in transactions jockeying for execution order within a tick.

On Lazy Liquidity

When I reflect on the AMM tradeoff piece linked above there is a hole in the theory, namely the effect of aggregators. Aggregated liquidity has a parasitic effect on lazy LP's, particularly the PMM model (private market maker) employed by most leading aggregators on highly liquid venues. It is parasitic because prop market makers hop in selectively to fill non toxic flow and don't have to take the other side of a chunky market moving order. Over time this erodes LP returns since the pros can jump the queue on an aggregator order, with marginal gas increases to the end trader.

The DEX to rule them all

This gets me to what I really think V3 is about - a credible attempt at becoming the decentralized trading venue to rule them all. By opening up the optionality for pro market makers as well as lazy LPs, Uniswap is attempting to corral both parties and force them to play under the same set of rules. This is where we get back to the pro-rata mix across an order. By mixing the order between lazy/active equally the issue of parasitic aggregator mm's is muted. The design traps passive and active LPs into the same order queue. The upshot being that active makers get their large cut of fees in exchange for taking larger price/inventory risk. Passive makers still get fees and benefit from the increased taker flow that will come due to more active liquidity.

But if and only if Uniswap is routed to directly on a high percentage of trades.

Direct routing will be tricky long term but there are two ways this could happen.

- The latency/infra cost of pinging MM's with an order outweighs the price benefit of routing outside of Uniswap. This will only happen if Uniswap is hyper liquid and block times are <<15s (e.g. on a rollup). Additionally, most aggregator routing schemes involve marginally increased UX and gas costs (although this is mostly an approval related cost which will subside as the approval flow is deprecated with account abstraction)

- Incentivize direct routing with $UNI. Uniswap governance is sitting on ~$5 billion of UNI that could be used to incentivize direct flow, rewarding both takers and routing interfaces. Not sustainable as t → ∞ but worth it if it allows #1 to come to fruition.

Many questions remain outstanding with the design. Will frontrunning/sandwiching remain persistent challenges? Is an order book actually a strictly superior environment for makers and takers? Nonetheless, the design is ambitious and changes the DEX meta once again.

Parsec Research is the research arm of parsec.finance which is in now live.

Thanks to Will Price for feedback on this piece.