Citadel's Sharpe is Uniswap's Opportunity

Automated Markets Makers (AMM's) are a relatively novel concept that has been popularized primarily by Uniswap. Most discussions around the tradeoffs of AMM's are usually of two forms. The first comes from experienced traders who can’t get past the inefficiencies that arise from AMM pool trading. The second comes from crypto native's who proselytize our future of peer to contract financial applications, preaching that lazy liquidity will by default eat the world. As a former algo trader, I certainly empathize with the first argument and have oscillated on this topic endlessly. But naturally the answer lies somewhere in between and is a discussion of a core strategy scalability tradeoff.

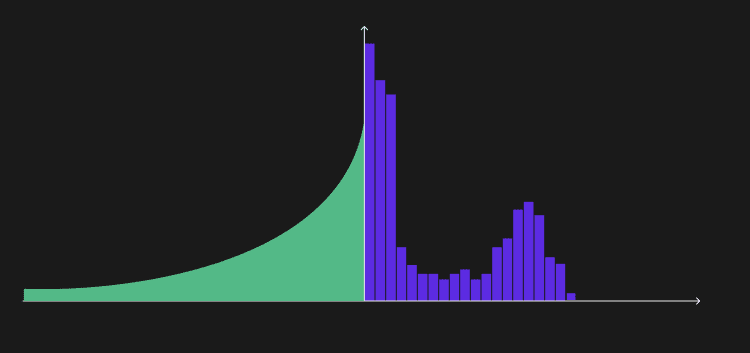

Imagine you have some trading expertise and you decide to spin up a market making bot. The goal of a market maker is simple, buy low and sell high, the difference therein being the spread. Seems simple enough, post an order inside the best bid, and another inside the best ask, your buy gets filled, price flips and someone hits your ask and you’ve captured the spread. The reality is a much more bleak affair. First you need to account for maker fees, which you will certainly have as a low volume mm, and additionally somehow you got left with a big inventory of the asset you were supposed to be buying AND selling, and now the value of that inventory has gone down 10%, losing any profit you made from the spread. The inventory bit is the key piece here, central to any market making operation is inventory management, how long do you let inventory sit on your books? Doing this well requires a combination of strong modeling and good tech that needs to be managed. Market making bots are not the type of thing you just turn on and let loose without monitoring, your funds are at risk, tail events happen and bugs are costly. The rigorous demands of market making manifest in maker volume that is steeply power law distributed. The largest market makers in centralized crypto trading and traditional finance are relatively few and dominant in market share.

Successful market making shops have two unique characteristics, first they have very high sharpes. Metrics like sharpe or sortino ratios are usually not emphasized in crypto, largely because holding crypto obliterates any sharpe regardless of how many 10x'ers are caught. But underlying model assumptions notwithstanding, high sharpe strategies are great because they can be levered up to an almost arbitrary risk threshold. In traditional finance, risk infrastructure of the type described in our last piece provides good market making shops with incredible amounts of credit and access to leverage, precisely due to the return profile of the strategies they run. The second key characteristic of these strategies is that they are scale constrained. Most of these firms manage their own money because raising capital doesn't actually gain them anything, in fact it would just dilute their own ROI. Many argue that a fundamental law of quantitative finance is that a strategy's sharpe and scale are tightly and inversely correlated, with very few outlying durable edges. Numerai notably, is a radical attempt to break this law, but largely this law has held true in capital markets thus far. In short, Citadel's sharpe is Uniswap's opportunity.

The AMM tradeoff then is a question of strategy scalability. AMM's will never compete with the dynamism and data edge of market making bots - full stop. But the scalability gains are undeniable. AMM's provide a more equal playing field for liquidity providers by locking them into the exact same strategy. Back to our makeshift mm bot earlier, the reason we got blown out is because of the other bots in the mix exposing us to a disproportionate amount of the toxic flow. The largest risk for market makers is what's known as adverse selection, i.e. when the taker knows something you don't, whether that’s a heavy bid on coinbase or a protocol hack etc... A good AMM effectively dilutes adverse selection pro-rata to all LP's. Uniswap does a pretty good job of this but there are a few avenues for LPs to avoid toxicity. Consider a sophisticated uniswap LP who is modeling price action and is also an arbitrageur. Given their infrastructure they can predict and spot flow that will result in material price change (meaning the price won't revert any time "soon") and realize some losses for LPs. In this case the sophisticated LP can simply remove their liquidity, execute the arb, re-add liquidity (all atomically!). This possibility was briefly discussed in the audit and is not meant imply that uniswap is specifically weak in this dimension (quite the opposite actually). Point being that LPs need to be constrained because if certain LPs have material advantages over others, returns will be suppressed for most and the scalability of the strategy are capped.

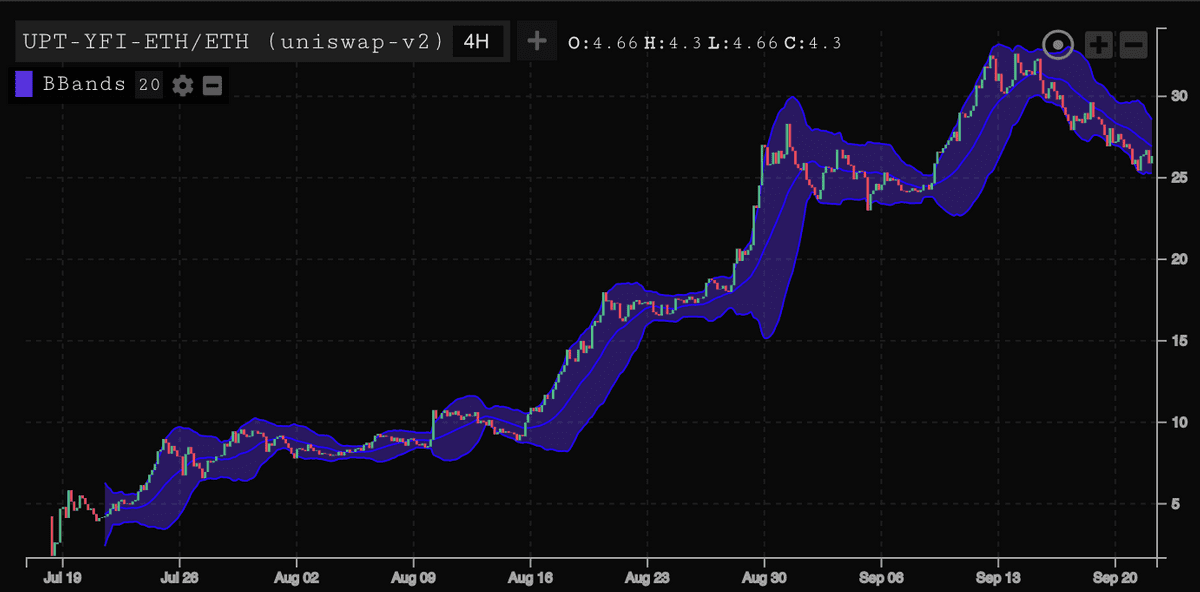

Instead of making AMM's more and more like order books by providing makers optionality, they need to lean into their strength and severely constrain makers. One way of additionally constraining makers is applying a time penalty to LP withdrawals as suggested by Tarun and Monet Supply, this would filter for higher time frame LPs and could entirely eliminate the LP sandwich attack by making the withdrawal fee 100% for a 0 block deposit. The upshot of the constraint on makers is that the strategy is fungible in a literal sense tokenized. Consider a new AMM that allows for arbitrary curves mapped onto one another, and maybe even discrete limit orders in the mix as well. In this environment all the makers are operating on different terms and therefore their distinct strategies cannot be tokenized, tokenization and maker constraints are almost tautological and AMMs with LP exit games will not be able to offer safe tokenized representations. Early research on LP tokens is promising and could become a genuinely unique DeFi primitive by democratizing Goldman's structured product desk. In practice the returns have been a bit hard to pin down and have been maligned by always comparing returns against a benchmark (impermanent loss) instead of cash. The dream LP return profile is one that has a high volume/liquidity ratio and a high sharpe. Here the AMM cannot cap the AUM and lever it up, it will have to accept new LPs that flatten the returns to a point where inflows match outflows, resulting in hyperliquidity.

Parsec Research is the research arm of parsec.finance which is in private alpha.

Thanks to Sherwin Dowlat for feedback on this piece.

p.s. parsec is hiring - reach out to me!