The DeFi Prime Broker

In traditional finance, when you hit BUY on screen. The experience is seamless, and in a few seconds you have price exposure to a financial product. Behind the scenes an absurd amount of financial engineering and infrastructure allows for such a seamless experience. A distributed systems problem ensues between algo traders, brokers, investors, copious regulation and dozens of other intermediaries. DeFi flips this on its head by allowing near instant settlement and direct custody. That being said, as open financial primitives continue to develop, aggregated prime broker like protocols will emerge that squeeze inefficiencies out of the market and dramatically increase the liquidity and therefore the utility of the entire market. The central question is then what do these protocols look like? As the community has begun to discuss this, the narratives have trended towards existing protocols expanding by providing more and more financial products and protocol level rehypothication and margining. Dan's aquaponic piece on aquaponic yield farming and Trent's fantastic thread steelman this vision, with Synthetix being the most obvious example of this effect already in action [1]. However, my goal here is to layout an alternate route, one that seeks to separate asset and derivative issuance from prime broker like services.

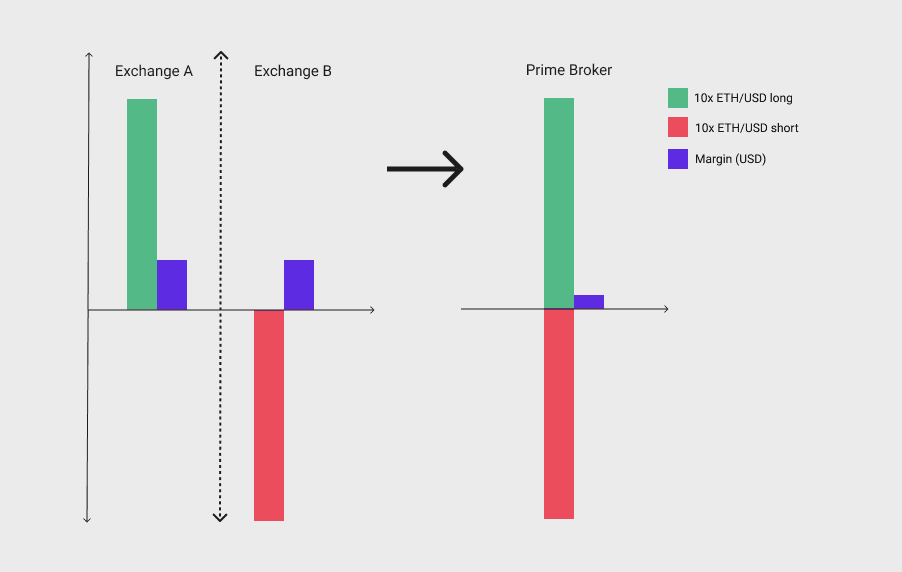

Financial markets become hyper liquid under certain conditions. The first is genuine demand and trading flow, which DeFi is increasingly seeing with record DEX volumes [2]. But the second condition is risk infrastructure in the form of derivatives markets and associated clearing and settlement. The simplest example of clearing is an arbitrageur who is 10x long BTC on exchange A and 10x short on exchange B will not have to post full collateral (or any at all) due to the offsetting nature of the positions. For those that have traded on centralized crypto derivatives exchanges like BitMex, the cross-margin provided by these exchanges is a simple example of this type of risk infrastructure. The limiting factor being it only applies to that single exchange. Once clearing is introduced hedge funds, quant firms, and traders are able to execute incredibly capital efficient hedging and arbitrage.

Centralized crypto markets have quickly stacked derivatives markets on top of the nascent industry, particularly via futures and perpetual futures contracts. However clearing is still far behind the standards in traditional finance. There are a few reasons this infrastructure has not emerged in centralized crypto trading, all deserving of longer form explanations, but long story short it isn't there yet and this presents an opportunity for DeFi to leapfrog the dominant CEX market share.

First consider the vertically integrated DeFi prime broker or the "liquidity black hole". The protocol issues derivatives and synthetic assets which can then be traded efficiently with clearing technology that allows for the netting out of offsetting positions, this is great from the users perspective because they can keep all their funds in one system. But, by coupling the clearing and issuance the protocol has layered two separate types of risk. The first being protocol risk, which consists of upholding the core competencies of the financial primitive. In the case of synthetic assets like DAI or sBTC, how strongly is the asset pegged, what mechanism's fulfill its value? With an options contract, what are the assurances around ability to exercise, is it cash settled or physically settled? For a predictions market, who determines what the outcome was? does the oracle require streaming data or one-time settlement? Are the contracts fully collateralized? All this on top of actual smart contract and base layer security.

Clearing risk, on the other hand, is an abstraction of protocol risk, an engine that produces a willingness to treat assets as similar or offsetting and fulfills users positions optimistically. Each protocol represents a unique set of tail risks for the clearing agent. Any client of the broker will want protocol risk to have been ruthlessly and impartially priced so as to avoid any insolvency scenarios when protocols go sideways. Equally important to clearing risk is the actual modeling of related but distinct products. Consider a uniswap LP share on ETH/DAI and an 10x long BTC/USDC dydx perp. Calculating a low risk and efficient offset here is non-trivial and requires skilled modeling of the derivatives and the underlying.

The point here being that the risks are different in form. The entities attempting to mitigate these two types of risk have different goals. The protocol's goal is to provide economic security, strong pegs, settlement assurances etc... Whereas the clearing broker provides a probabilistic approach to solvency, i.e. as long as the fees they charge are greater than the risk they bear in clearing positions, they remain solvent and profitable. Many protocols do take probabilistic risk during operations like defaults, however these are concentrated risks meant to be uniquely solved by the construction of the protocol! Our vertically integrated DeFi protocol has compounded their risk of ruin by layering these distinct risks. This is not to say there should not be intra-protocol clearing - Opyn for example is moving towards allowing reduced margin for options combinations like spreads to increase capital efficiency [3], and as they should! Any option writer is going need intra-protocol clearing to be maximally efficient. The point is that the opyn system should not then go on to offset positions against sETH or ETH/USDC LP shares as that entails a whole set of risks unrelated to the core business of the protocol.

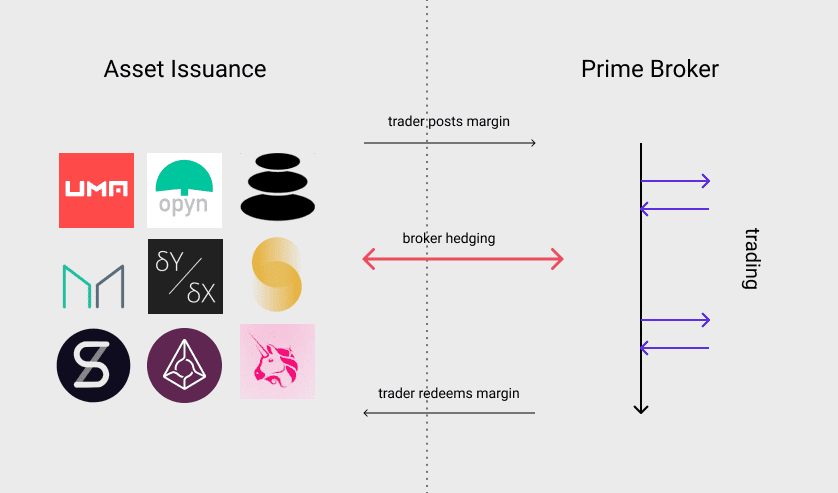

Enter the DeFi prime broker. The broker has no allegiance to any protocol, just risk models that assess the interchangeability and composed return profiles of various assets. The broker will allow reduced margin on a long sBTC position and a short BTC-PERP position. The upshot being tighter spreads and more liquidity on any asset/market cleared by the broker. Practically what does this look like though? From a high level the broker accepts collateral in anything it understands, as a trader you'd likely just deposit your cash, whether that be USDC, ETH, or synthetic BTC. Once funded the broker facilitates exchange and credits/debits your account as you trade. In order to actually provide settlement on exit the broker will need to hedge positions via main chain interactions with respective protocols. Those who wish to continue using the core protocols now find that the markets are more liquid due to the brokers flow feeding back into the underlying protocols. Ideally there are multiple DeFi clearing brokers, each with different offerings and risk settings to provide for every level on the user risk spectrum.

The elephant in the room here is privacy. The broker's hedging flow will be frontrun by sophisticated participants by seeing a large print inside the brokerage and frontrunning the incoming hedge from the broker. It's unclear what the actual mitigant of this is, whether its dark pools, private brokerage positions, OTC flow via aztec assets, etc... In fact, its likely a combination of all of the above. In order for the core tenants of DeFi to remain intact the new financial system must simultaneously remain open and inspectable, while also preserving trader's ability to get in and out of positions privately, a uniquely tall order.

Structurally the system requires some centralization tradeoffs to allow for such capital efficiency, the ledger kept by the broker would need some custom rules around things like position sizing and withdrawal latency. The actual trading ideally would be facilitated by a high speed L2 trading system like zk-rollup or whatever the latest and greatest L2 design is. As Ethereum slowly transitions to ETH 2.0 and sharding, L2 constructs like this become even more appealing. Aave could sit on one shard, Synthetix on another, Augur on another. Since the broker already takes latency risk they are more capable of handling the complexity and asynchrony of cross shard contract calls and communication.

If an Open Financial system is to reign supreme, it needs to avoid the mistakes of its predecessors. Protocols will fail, risk taking clearing brokers will fail, mercenary funds will emerge that will gap your favorite coin to $0. What is maximally important is that there are no sleeping giants that threaten to tear the entire system down when they go toxic. How do you avoid the global financial crisis of DeFi? Don't even have a Lehman Brothers or Bear Stearns that can take the entire system to the brink.

Parsec Research is the research arm of parsec.finance which is in private alpha (please contact me if you'd like to join the alpha!)

Thanks to Eli Krenzke for feedback on this piece.