Open Optionality

The crypto options market has been slow to develop, with Deribit finally breaking through and providing the first retail friendly crypto options products. As with many crypto derivatives products they are unavailable to Americans, and they are custodial. The fact that the crypto options market remains immature presents a huge opportunity for Open Finance. Options are complicated not in their structure but in their pricing and margin requirements. An American style option is simply the right but not the obligation to buy or sell the underlying asset at the strike price before some date. If physically settled you don't even need an oracle. The challenge, as is often the case with DeFi, comes down to liquidity.

The true emergence of DeFi has come from pooled liquidity models, most notably Uniswap, Compound, and Synthetix. Peer to peer models have been largely dwarfed by these protocols, most evident in Dharma's pivot from a p2p loan book to a Compound interface. Each of these protocols have different risks associated with pooling liquidity, but generally these models allows risk seekers to set it and forget it, without necessarily actively monitoring the risk/return associated with pooled products. This leaves a sophisticated market maker with fewer avenues to generating differentiated alpha, for example in the case of Uniswap all one can do is add/rm liquidity. By limiting sophisticated participants alpha, protocols can accrue "lazy" capital. New Ethereum options protocols, notably Opyn and Hegic, have recognized the need for pooling and are building pooled options protocols.

Opyn

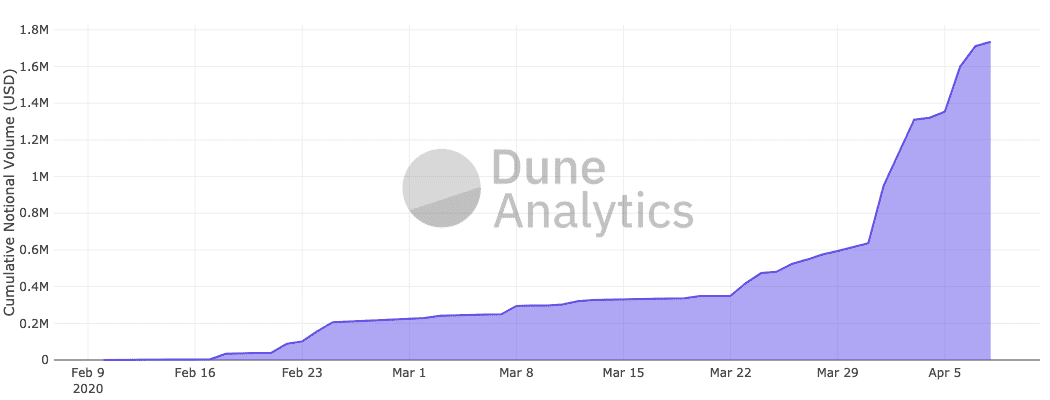

Opyn is built on the convexity protocol, a vanilla options protocol with some key additional features [whitepaper]. In a short time Opyn has accrued meaningful volume, particularly with the ETH put product.

Take the case of an ETH/USDC $100 strike; in a standard option put writers would lock up 100 USDC as collateral (in a 100% collateralized or covered setting) in exchange for a premium. If the option buyer exercises, they send in 1 ETH and receive the full 100 USDC back. With Opyn, it's quite similar: an option writer sends in 100 USDC in exchange for one fungible oToken. In order for the writer to realize this premium they need to then sell this oToken on an exchange.

One important feature here is that there is no connection between this oToken and the 100 USDC deposited, the oToken is a claim against a pool of collateral. Therefore, option writing is peer to contract. In a 100% collateralized context this is moot, however the pooled structure provides two key features in other regimes.

First, collateral can be provided in a currency other than the quote asset with a liquidation scheme similar to compound and dydx, bolted on top. Opyn has launched with a few such markets. The ocDAI puts markets use ETH as collateral, the primary reason being ETH's yield << USDCs yield. This is an opportunity cost argument, in that by locking up USDC in the market you are taking on compound risk without actually getting the fairly sizable yield USDC (usually) generates. By using ETH, a writer is forgoing a 2 BPS APR and earning a premium on the order of 1%-10%. The tradeoff is an over-collaterization of non-strike asset collateral, currently set to 140%. Let's assume a safe position would leave room for a 20% drawdown, that leaves 175% ratio. The decreased capital efficiency both limits sell side liquidity as well as spreads the premium across more capital than it ideally would.

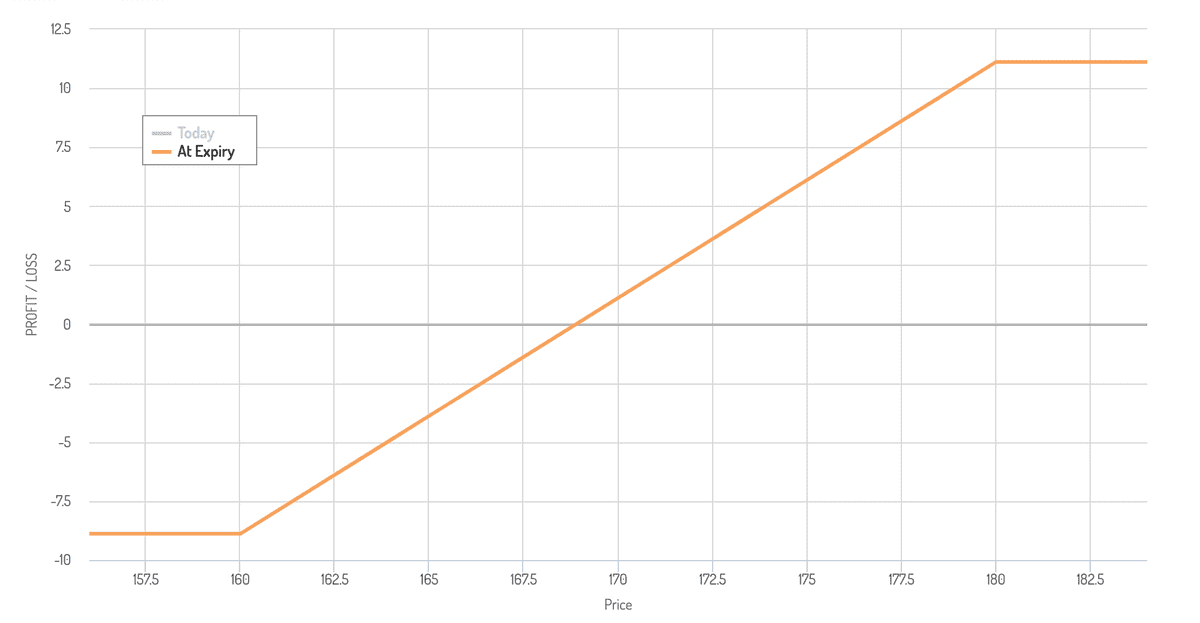

The Second benefit of pooled collateral is that it provides a pathway to a pooled unsecured writing pool. I remain convinced that the only way forward for lending, underwriting, etc, in DeFi is to pool risk and reduce the onerous capital intensity of these products, if CeFi and BitMex has taught us anything it is that leverage is king. By pooling option collateral, Opyn has a viable path forward to ratchet down capital requirements and require less than 100% collateral for option writing. One concrete example is a "credit spread" trade.

When a trader enters a credit spread they have capped both gains and losses at the boundaries of the spread. Therefore, by netting out the positions collateral requirements can be reduced to the max loss, in this case $20. In this case netting out the trades would increase capital efficiency 9x. Since collateral is pooled a user would be able to execute this atomic credit spread with $20 of margin while adding zero risk to the underwriting pool.

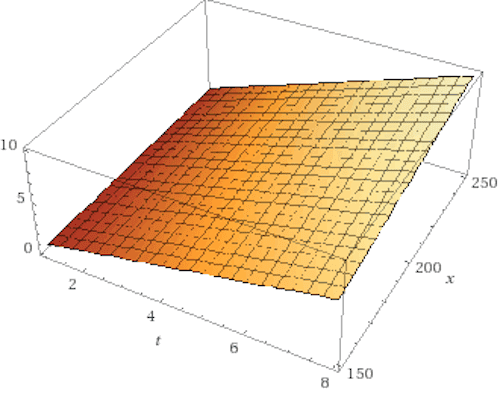

Another avenue to unsecured writing with Opyn is a maintenance margin model similar to UMA. The idea here is to value an option writer's exposure and maintain collateral at some multiple of that, creating a scenario where the current value of the position is collateralized but full exposure is not. For deep OTM options the value and exposure can be wildly out of balance, take the ETH 04/24/20 $100 strike, currently trading at $0.90, the full exposure here is 1 ETH, a large cost to pay for 90 cents of premium, in a maintenance margin system, perhaps 2x the value would need to be margined and continually topped up if the value increases. Clearly this model has huge capital efficiency gains, but it injects a host of very difficult problems. First, oracles must value the option, oracleizing this safely is technically and mathematically demanding. Second, keepers must participate in liquidations of undermargined positions, makerdao learned the hard way that keepers won't always show up.

Once the options are written and collateralized, the process of actually selling the token is up to the market. Opyn's current liquidity venue preference is Uniswap, easy to setup and add liquidity on an asset that is liquidity challenged. Great for the sellers and buyers but - the LPs are involved in quite a complex product here. Uniswap LP returns profile are non-trivial to understand [see this in depth post] The gist is that large directional moves that outpace fees push returns negative. For oTokens an LP must be very careful, particularly with out of the money strikes (OTM). OTM strikes usually expire worthless as the time premium decreases to 0 as the expiry approaches. As the price grinds to ~0, LPs effectively sell all of their ETH for the expiring oTokens. This is untenable for an LP and we can't expect any real liquidity on these markets as the probability of them being in the money approaches 0. This is the same reason AMMs don't work well for prediction markets. The question for Opyn then becomes, does pool trading liquidity arise from a pool of AMMs across strikes/expiries? Or does a classic order book do its thing and onboard traditional options market makers. The order book route is much easier but likely lacks the structure that has proven successful for DeFi protocols.

Hegic

Hegic, in true cypherpunk tradition, is created and operated by an anon founder called Molly (can I be Case?). Hegic is a novel approach at an on chain options protocol. With Hegic the option writing and selling is done by a pool of participants [whitepaper].

In simplest terms, Hegic is a contract that writes options by request. A buyer is quoted the cost for an option for a fixed duration (1, 2, 4, or 8 weeks for now). If bought, the pool locks in the corresponding exercise collateral until expiry or exercise. By contributing to the pool, LP's earn option premia pro-rata and accordingly accept the risk of a buyer exercising a profitable trade. Hegic has therefore pooled both the underwriting collateral base as well as the buying/exercising of the options.

As an option buyer, Hegic provides incredible UX and liquidity problems are alleviated assuming the collateral pool is healthy. Illiquid options are often ones of the most interest, think Tesla's going bankrupt? buy a $100 put. The issue is that these products traditionally have high spreads and a dearth of participants willing to take the other side. Hegic will always take the other side.

As an LP you are consenting to options being written against your collateral; this is scary. Options writing is a very complicated business and any spot or futures hedging must be done outside of Hegic. The goal of an options market maker broadly speaking is to write options slightly above true value and take as little of a position as possible on the underlying. Hegic currently has no way of limiting LP's positions. With puts only, Hegic leaves LP's structurally long ETH. That's fine for many people but there are safer and more profitable ways to be long ETH. The introduction of calls will help alleviate this but the lingering issue is skew. Imagine there are 100 contracts out, 90 of which are a single OTM put, LPs position against the owner of the 90 contracts completely outweighs the rest of the pools positions, leaving the LPs as simply speculators. Synthetix faces a similar problem with the pooled liquidity of synths. The perpetual swap funding model combats a similar problem, however a funding model for Hegic will likely be an order of magnitude more complicated.

The obvious question then is how are the options priced? Prices need to be competitive and protect LP's, a tall order. Initially the pricing model is simple: take a percentage of the strike price, this percentage decreases linearly away from the current price, and at exercise charge a small exercise fee. The end product is a constant pricing function with discrete entries (strike + duration) across the surface. The current model is striking in its simplicity but is being upgraded for v2, in order to attract sophisticated LP's who don't enjoy getting their face ripped off.

It's worth considering what happens if and when Hegic misprices an option. Once moderate liquidity is achieved, arbs will flow from Deribit; in most cases it won't be a clean 1:1 arb because of the bespoke expiry's and inability to write directly, however, sufficient price discrepancies will deliver large profit opportunities. In most arbitrage the size is limited to the less liquid venue. With Hegic the liquidity for any contract is the remaining size of the entire liquidity pool, this will lead to distortions in the Hegic LP's ETH position as previously described. Ultimately the goal becomes protecting LP's against huge losses, making an "accurate" price paramount, this is the only way Hegic will achieve liquidity.

Additionally Hegic is going to introduce a token ($HEGIC). The token provides special privileges to both buyers and writers. Holders are given access to discounted hegic contract premiums. Holders that contribute liquidity to the writing pool are given priority unlocks, the way liquidity unlocking generally works is that if there is enough free liquidity an LP can unlock, if not they enter a queue and wait liquidity to free up. By holding HEGIC LP's can swap against the development fund (funded by sales of HEGIC) even if there is no free liquidity in the pool. Finally, HEGIC is a DAO and the tokens provide voting rights for protocol upgrades a la MKR. While the token may to some look like a superfluous addition the reality is that protocol upgrades will always require work and funding, with investment flow coming from option buyers/sellers and community members who want to share in the upside of a protocol.

Onward

Options markets remain fairly immature across crypto exchanges, presenting DeFi with a massive opportunity to develop some liquidity and perhaps become a competitive alternative to Deribit. May the day come to pass that an Opyn or Hegic option graces the hallowed grounds of WSB

Thank you to Zubin Koticha (Opyn) and Molly (Hegic) for discussing you're protocols with me, subscribe below for future pieces